One of the hottest phrases to be associated with these days seems to be “Super App”. Behemoth apps like WeChat and AliPay are commonly lauded as examples while others such as Grab and Go-Jek often claim that they are, or aspire to be, one.

What is a “Super App”? Simply put, it is an app that consolidates at least a few services or consumer use-cases, that usually be otherwise on separate standalone apps, into just one user-friendly, all-in-one app. The point is usually to dominate various, often disparate, consumer use-cases and make it convenient for one to do everything they need on just one app, eliminating the use of others. The point behind this? Data. More precisely, to have the opportunity to analyze it. By hogging screen time of consumers, these “Super Apps” accumulate a trove of invaluable data that can be used either to improve on their own services especially in a targeted manner (e.g. advertisement, loans and insurance issuance, wealth management etc.) or either sold to other companies.

Interestingly, the examples quoted above are all in Asia. In the western side of the world, people still largely use one-function apps and there hasn’t been companies of note that have taken on the “Super App” strategy. In WeChat, you can chat with your friends, order food delivery, pay your bills, purchase a movie ticket and call a taxi just to name a few use cases. In contrast, in the U.S., you chat using Messenger, WhatsApp or Line, order your food perhaps through GrubHub, UberEats (anomaly here) or PostMates, call a taxi through Uber, Lyft or Gett/Juno and get a loan through the many bank apps. There is no conclusive reason to this, but one reason is that it is because in Asia there is a mobile first trend, where consumers first start getting online and the phone is their primary method of accessing online services, whereas in the west people already conduct many of these transactions on the many other devices they have. Another reason is because of the emphasis on social media presence, which is more easily accessed on the phone, which leads Asian consumers to want to do more using their phones than on other devices. Regardless, to become a “Super App” seems to be a trend in Asia and ZaloPay is one that has set its sights on cornering the Vietnamese payments market, which is projected to grow at ~18% CAGR from 2018 to reach ~$70B by 2025.

Who are they?

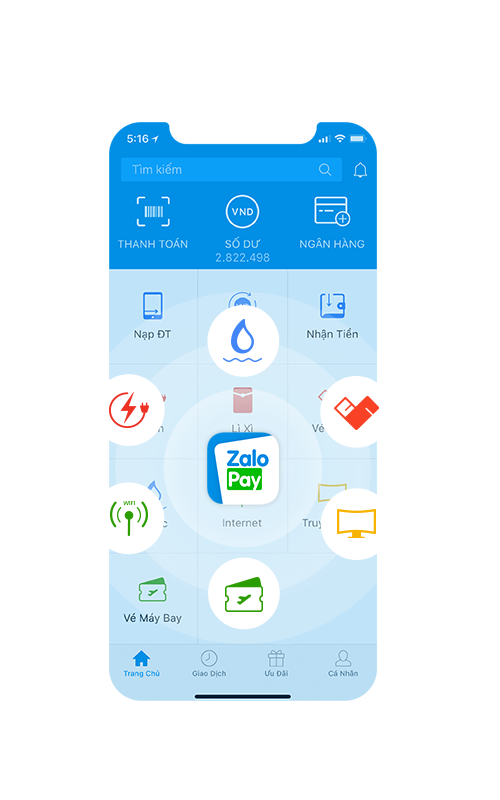

ZaloPay is a mobile payment application with use cases for daily life and business needs launched in 2017, relatively late in the payments scene compared to competitors like Ononpay. Some examples of use cases are P2P fund transfers (via QR code or registered phone number), utilities bill payment, phone top up and credit card bill payment. Similar to how AliPay was developed as one of three tenets of the “iron triangle” (the others being e-commerce and logistics), GrabPay as an enabler on the Grab ecosystem and WeChat Pay on a social media platform.

ZaloPay aims to tackle the fragmented payments and apps market in Vietnam, where bank coverage for goods and services payment is poor and where they (to a limited extent) exist, app and online services are not very user-friendly and singular in nature, resulting in a clutter of apps on anyone’s phone.

ZaloPay is built on top Zalo, the most popular messenger app in Vietnam which was launched in 2012, with >35M active users. Zalo, in turn, is a key product of the Vietnamese conglomerate VNG (formerly Vinagames), Vietnam’s only home-grown unicorn. Although relatively late in the scene, having already had a massive user base helps, especially in a segment where arguably more users begets more companies (and use cases) being willing to go into partnerships and hence generating more users, a natural flywheel effect. As of late 2018, it claimed to have ~1.2M retail locations. ZaloPay has been trying to promote the use of QR codes, as opposed to the costly and inefficient method of issuing POS machines, which might be a good strategy given that QR codes are increasingly common in Vietnam and is now implemented at 18 banks.

ZaloPay was ranked the 3rd payment application of the year at the 2018 Tech Awards ceremony held by VnExpress newspaper, while competitors MoMo took the top spot, followed by ViettelPay.

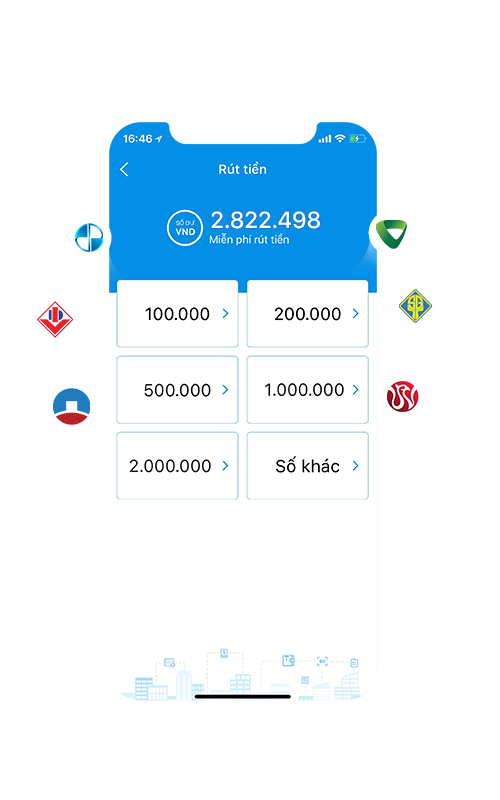

Photo credit: ZaloPay website (ZaloPay interface showing use cases and cash out capability)

ZaloPay also installs ZaloPay terminals at physical stores, which allows users to deposit and transfer money (as well as remittance), make online payments and pay their bills.

What is the team?

ZaloPay is led by Dang Viet Dung (Dzung Dang), former CEO of Uber Vietnam for 3 years, who officially joined VNG in early 2018 as Head of Payment Business VNG – Director of VNG’s payment business, in charge of all payment, including ZaloPay, 123Pay.

What is their value proposition?

ZaloPay’s biggest value proposition versus its competitors is familiarity, trust and convenience in setting up. Since many already use Zalo for messaging, it is both easy to adopt ZaloPay (no additional registration needed) and it invokes greater trust in the product, which is extremely important in the payments / ewallet industry.

On top of that, they also offer (supposedly) instant cash out capability to any linked bank account (each ZaloPay account can be linked to multiple bank accounts), which is important for consumers and differentiates them from other wallets such as Grab.

Take the Grab-Moca episode in October 2018 for example, when Grab migrated their users over to Moca, many were stranded and unable to access their wallet due to a KYC process that was not well communicated, resulting in what must have been a huge hit to their user base.

Because it already has a large user base, it is also probably easier for ZaloPay to negotiate partnerships with companies and bring more variety, or increased, use cases to the platform.

However, a quick look at their appstore pages reveal that many users have been facing issues such as linking bank cards andslow refunds after transaction failure. There have been user complaints about promotions not being clearly communicated, resulting in unintended top ups and that there are substantially fewer bank options to link to compared to competitors like MoMo and ViettelPay. The ZaloPay team looks responsive to these feedback and hopefully that means that at least users can be pacified, but in the long run the focus should absolutely be on gaining trust of users and working towards making the app integral to daily life.

Further reading

- Why the next big thing in fintech is not mobile payments

- A mobile wallet to help Vietnam’s unbanked become financially savvy

- ZaloPay use guide by a blogger

- Vietnam Messaging App Zalo: A Super App which might be bought by Facebook in 2020

- E-payment soars in Vietnam as a solution to skimpy bank coverage