The current health climate brought sharp focus into industries like healthcare and travel (airlines etc.). On healthcare, we are seeing a concerted effort across industries to mitigate the impact of the COVID-19 – pharmaceutical companies in a rush against time to develop a vaccine for COVID-19, while U.S. president Donald Trump has hinted at, after months of calls to, invoking powers under the Defense Production Act to direct manufacturers, including Ford and General Motors Co, to produce ventilators. In contrast, the travel industry has been under siege as the contagion grows. Travel, both international and even in-country, has almost grounded to halt with many countries on lock-down, leading to airlines to furlough their staff and grounding their planes in aggressive cost-cutting measures, and asking for government help (bailouts, or raising funds from existing investors in a rights-issue, as with Singapore Airlines).

For startups, where arguably cash-flow is much tighter and funding sources are less readily available, the challenges faced are great. Operating in an environment where fund-raising is tougher given the tumultuous and uncertain markets, negative customer-sentiment and weakened appetite and ability to spend makes it hard to get traction on their products and services. It would be great, then, to hear the views of VCs who have portfolio companies operating in the space.

The “Through the Lens of Investors” webinar was conducted by WebinTravel and moderated by Yeoh Siew Hoon, Founder of Web in Travel, when Hian Goh, Partner at Openspace Ventures and Kuo-Yi Lim at Monk’s Hill Ventures on their perspectives on the impact of COVID-19 on the travel industry and start-ups in the industry:

BEACH (Booking, Entertainment & Live Events, Airlines, Cruise Lines & Hotels & Resorts) stocks have taken a hammering with the Covid-19 crisis. More than $332 billion in value have evaporated over the past month, according to the visual in this analysis. How are investors in Asia, both VC and corporate, viewing the storm that’s marooned travel? And how are they advising their portfolio companies to weather it? What’s the responsibility of investors at this moment in history?

In this episode, as part of our “Unity In Crisis” series, WiT Virtual brings together three investors – two who run VC funds out of Singapore, with strong interests in South-east Asia, and a corporate development executive sitting within one of Asia’s largest OTAs – to get their perspectives on the ongoing Covid-19 crisis.

How many months of cashflows will travel companies require?

Kuo-Yi: What we fundamentally need is a pharmaceutical response and at least 12 months. Businesses have to figure out to get to an as longest run way as possible. Particularly for travel businesses, not just regional and long distance, but the countries themselves. Cutting costs where they can to as bare bones as possible.

What was your darkest moment? Hian had wrote about running Asia Food Channel

Kuo-Yi: Year 2000/1 during the dot-com/9-11. Next during the GFC. Between 2002-2008 is closer to what we are experiencing now. There was a long stretch of recession and there not being the luxury of doing too many experiments. Why are customers needing your stuff right now and not later.

Buy or sell? Is now the best time to sit on investments or sit on the sidelines and wait for things to settle down

Kuo-Yi: Fundamental question is whether funds are there to allow businesses to grow in this current situation.

How many portfolio companies in travel do you have and what is the situation with them now?

Kuo-Yi: In total about 26 companies (4, soon to be 5/6 for Fund 2). Spending a lot of time right now to review business plans, projections and taking stock of where people are at and where they will be at. Travel is the heaviest slammed and not unlike other travel players, they are affected. There are some set of consumer linkages that are also affected, like lending. There are more people who want to borrow but it is not necessarily the best time to lend too much, hence a disconnect.

Last week CEO of KKday spoke about tapping into interest of Taiwanese on glamping. Is it wise in the short term to survive to divert the team to solve non-travel problems? Have there been any interesting examples in your portfolio companies or other startups that have?

Kuo-Yi: not so far. As a business owner you have to do what you need to do, there is no need to pivot or pare back or put a pause on what you are working on. Travel ultimately is about: entertainment, experiences.

Will there be any opportunities coming out of this?

Kuo-Yi: what are the structural or fundamental changes in economies we can expect to come out? View is that when all is settled, things will go back to what it was before, people will be more wise with personal hygiene, companies will be more aware with preparation for disruption and BCP, having the appropriate tools. Anything that helps with risk preparation will be more needed in the near term.

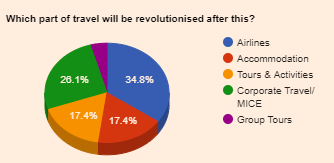

Out of 2008 crisis, we got Uber which changed the taxi industry forever. Which part of travel do you think is most susceptible to change, which part of travel will be revolutionised after this?

Quite hopeful and somewhat contrarian view. When this is over, as far as travel industry is concern, things will be alright. Humans are social and people like to go out and experience new things, which will not change. Group tours and cruise ships might have a direct impact and not be the best idea for many people but more other things, would likely go back to normalcy.

Do you see travel being driven by sense of purpose? E.g. wellness travel

Kuo-Yi: People will be more aware of themselves and health. >80% of people who died from COVID-19 also had another underlying condition. Hence being consciously aware of health will be a focus.

How will this crisis change logistics? We read reports of drones delivery medical supplies. How are you ramping up Ninjavan to respond?

Kuo-Yi: Un-manned delivery will always be around the corner, not just because of this virus. People are hard to manage at scale and that will drive the change. This situation accelerates it. Logistics is an enabler. With eCommerce being a norm, the situation has boosted the relevance of it, it has become an essential service, like healthcare.

Ninjavan is able to scale up to manage peaks. For example during shopping festivals. Logistics have been affected due to shutdown of China. In the Philippines, logistics was seen as non-essential.

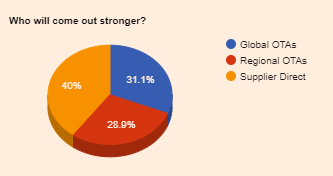

Who will come out stronger? Global OTA, Regional OTA, or Supplier Direct?

Kuo-Yi: The strong will get stronger and the weak will get culled.

Do you see many of your portfolio companies struggling to raise funds? Are there VCs re-negotiating valutions?

Kuo-Yi: Anecdotely, valuations are taking a longer time. With team members across Southeast Asia, this has been more effective. Would not be surprised if there are re-negotiations, although we have not done it.

Hian: Best way to look at it would be that if we stick to value before COVID, might run into problem of not being able to reach valuation expectations in next round. When the market was getting hotter, people were also raising valuations and taking advantage.

Would people’s perspective of travel change?

Hian: Have always looked at registration number of airplane and do checks. Many quality cariers are flying old airplanes. Have a high sensitivity of safety. Health and cleanliness could have been something that was tucked away. Price and flexibility were the main factors for people instead of age of aircraft.

Kuo-Yi: Taking cue from 9-11 and SARS incidents. First, after 9-11 there were additional checks. For now will there be more temperature checks. Second, after SARS incident, there was more consciousness on how hygiene is managed, for example elevators being cleaned. These will be table stakes and hygiene factors, rather than differentiating.