Introduction

Since the Bitcoin (BTC) whitepaper was published in 2008, the cryptocurrency has gone through cycles of booms and bust, and public opinion has largely been divided. While in one corner of the ring proponents argue for it to be a possible alternative to gold as a store of value and potentially even being the panacea to long-lasting pain points in payments such as the high cost of remittance and sky-high inflation in countries without a developed monetary policy or system, in the other corner there are critics that often point towards its association with illegal activities, in particular on the dark web. In the first half of 2019, BTC has been involved with $515m worth of illegal activities, and it is expected that this will exceed $1b by the end of 2019. An example is at the end of 2019, popular Korean crypto exchange Upbit experienced a hack of 342k ETH (close to $50m worth at the time), the seventh-largest in 2019.

While the blockchain and cryptocurrency industry is relatively nascent, it is extremely fast-growing, with adoption increasing tremendously over the past few years. From a total circulating supply (or market cap) of c. $15b at the start of 2017, it experienced a huge boom in 2017 to grow to a peak of c. $320b by the end of 2017, and then fell to c. $128b by February 2018. While this has not moved considerably much until a run-up in July 2019 largely contributed by the popularity of initial coin offerings (ICOs), the ecosystem and community have remained very active, with long-term enthusiasts, developers, and believers in the sector continuing to build and ideate.

Parallels have often been drawn between the rapidly developing blockchain industry and that of the internet, and if the latter is to be modeled against, the increasing adoption and development of products and features on technology require a strong infrastructure that is supported by key ancillary products and services, the “picks and shovels” that enable the industry to flourish.

Merkle Science is a company that provides blockchain transaction monitoring and intelligence solutions for crypto asset service providers. This enables stakeholders in the ecosystem to detect and prevent criminal activity and financial crime and thus promote the adoption of blockchain technology.

Overview

Merkle Science is a B2B provider of Risk Monitoring solutions to detect and prevent the illegal use of cryptocurrencies. Merkle’s mission is to be the layer of security for the future of finance. For cryptocurrencies, in-coming and out-going transactions on, say, BTC and Ethereum (ETH) need to be monitored

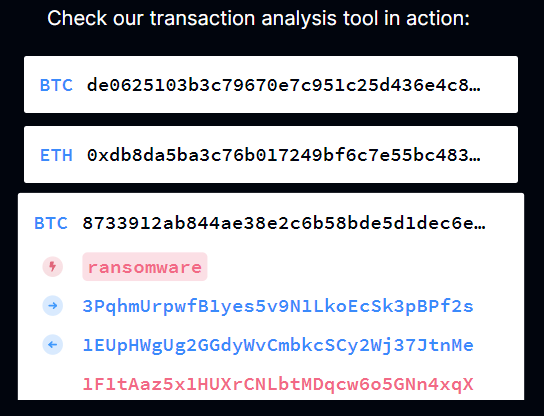

A traditional cryptocurrency exchange will do a KYC where they collect documents of customers. On top of that, Merkle Science provides an additional layer, using various sources such as blacklisted addresses of ransomware, dark web purchases, other illegal activities like hacked wallets.

This information comes from three sources

- A lot of this information is government-provided

- Private blacklists by working with investigation groups

- An in-house team that curates a list from various sources

Their target customers are companies that place a high priority on compliance and regulation, with trust from end-customers of utmost importance:

- Financial instiutions that want to satsify AML compliance obligations, receive due diligence reports, and be quickly alerted to cyber threats

- Law enforcement agencies that need to understand and evaluate blockchain businesses under their purview, and make investigations

- Cryptocurrency exchanges and any other crypto businesses that need to have transaction monitoring and want it automated, satisfy their AML compliance obligations, and for risk management

Market

Remember the dial-up era of the internet 30 years ago, when we would hear the beeping apogee that signaled our entry into the internet? At the time, computers, let alone palm or portable devices, were not priced for the mass market and access is very much limited either to the better-off families or used in a shared environment. Today, it is ubiquitous and for countries such as China, the entry to the internet is primarily through the mobile phone, leap-frogging the computer. The adoption of cryptocurrencies can be thought of as taking a similar path of adoption, with the existing number of blockchain wallet users c. 50m but expected to double in the next 7 years, as can be seen in the chart below. However, this still pales vastly in comparison with that of the internet and world population, signaling a huge potential addressable market.

Today, blockchain is an intriguing technology which underpins cryptocurrencies and can spur innovation through its application in areas such as remittance. While it is still nascent, it has the potential to revolutionize the global economy. Yet because of how closely it can be related to many facets of life, there are strong calls for the public to be wary of bad players and for regulatory bodies to take a stronger stance in the sector.

Products and Services

They have three solutions today, discussed below.

Transaction monitoring platform

The transaction monitoring platform provides near-real-time analysis that detects and flags suspicious cryptocurrency transactions. Leverage their proprietary risk algorithms for thresholds, laundering patterns, and layering heuristics, and an extensive database of cryptocurrency addresses to manage your cryptocurrency risk.

Forensic tools

Utilizing their in-house forensic tools, their analysts combine on-chain and off-chain data to provide a comprehensive analysis of a business based on its cryptocurrency activities.

The output is an in-depth Know Your Blockchain Business Report (KYBB Report) that determines the risk rating of a business and includes an analysis of the way the business moves and stores its crypto-assets, as well as categorizes its past transaction history based on its risk level.

This KYBB Report can then be used as part of an onboarding process or periodic review.

Compliance as a service

This allows customers to automate their AML compliance processes by relying on Merkle Science’s transaction monitoring platform and auto-generated reports. It also includes enterprise tools and support such as an Enhanced Due Diligence Report and on-demand fraud analyst for emergency cases. The Enhanced Due Diligence Report is generated with the assistance of their fraud analysts that combine on-chain and off-chain data for further investigative purposes.

Features

- API-based transaction monitoring

- Real-time transaction monitoring

- One-click automated report generation

- Multi-currency support

- Customizable risk parameters

- Enhanced due diligence

Financials and Key Metrics

There are no publicly available metrics. What would be of interest is customer metrics such as acquisition cost, funnel conversion rate, retention/churn as well as revenue, both amount and type (one-off or recurring). Their traction in partnering with crypto exchanges Ecxx (Singapore) and Tokocrypto (Indonesia) is encouraging.

Competition

This is a relatively new space, so there is not a lot of competition specifically in the area of blockchain and cryptocurrency monitoring.

There are elements of traditional finance that are applicable, just as the use of government-provided blacklists for screening. These include lists from the Office of Foreign Assets Control (OFAC) in the U.S., the United Nations, the HM Treasury (U.K.). In this aspect, companies such as LexisNexis, Refinitiv, ComplyAdvantage, or startups like Jumio. There is a potential threat of these players entering the blockchain and cryptocurrency space.

Team and Hiring Plan

- Mriganka Pattnaik (Co-founder, CEO) – Previously, Mriganka led business expansion for Luno, a Naspers-backed crypto exchange where he helped scale the crypto exchange from 5 countries to 40 across Asia, Africa and Europe. He has also previously exited his own medtech startup in Mumbai. He holds a Bachelors’ degree in Biotechnology from IIT Guwahati.

- Nirmal AK (Co-founder, CTO) – Previously, Nirmal worked at Paypal and Instamojo where he built their Risk and Fraud Management systems. He is involved in various cryptocurrency projects since 2017, which includes starting a crypto-mining hardware company, developing smart contracts on Ethereum, and Algorithmic Trading. He holds a Bachelors’ in Mechanical Engineering from the Indian Institute of Technology (IIT) Madras.

- Ian Lee (Counsel, Lead investigator) – Previously director of partnerships at the institute of blockchain, served as a consultant at Culturally.co, an internet marketplace for hand-picked, exclusive, hands-on cultural experiences in Asia, and legal experience in capital markets corporate law. He holds a Bachelors’ of Laws (LLB) at the University of Warwick.

Their existing investors are Digital Currency Group, Entrepreneur First, LuneX, Kenetic, SGInnovate.

Key Risks

Cryptocurrency has gone through many booms and busts, and the nascent stage it is in makes it challenging to predict its path of growth. Even if the general belief is that it can make an impact on the world, the adoption rate may be influenced by many factors, such as the affordability of hardware or software that enables it, that can be out of the control of Merkle Science.

While Merkle Science can benefit greatly from the growth of the cryptocurrency industry, arguments can be made of them being too “ahead of the curve”, much like cybersecurity is to tech companies in Southeast Asia. Decision-makers may be reactive in adopting their solutions, and it can be viewed as discretionary spending.

As with any B2B business, the sales cycle is longer, and the adoption curve may lag that of the retail customer. There may be a larger upfront capital investment required to develop the product and services to a level that is business-ready. There might be a long time before commercialization happens.

In addition, cryptocurrency regulation and customer adoption will likely differ vastly by country. Hence the company may have to take, if they are not already, a more global approach to their business.

Recommendation

The cryptocurrency industry is growing very quickly, and while most use cases and users are concentrated around the retail investor space, and distributed by blockchain companies, it may not be long before institutional customers adoption picks up, and traditional finance institutions (E.g. banks and especially the rise of digital banks) start offering such services as well. In this respect, Merkle Science can be a very useful service to such institutions and further expand their customer base.

As the sector matures, there will be an increase in bad players and also an increase in interest by regulators and concerns about financial crime and the well-being of users of the technology. As a result, Merkle Science’s business model will become an attractive one. With the added sophistication of incorporating blockchain monitoring on top of traditional, and potentially outdated or less relevant, ways of risk monitoring, Merkle Science can continue to differentiate itself.