Decentralized autonomous organizations (DAOs) are a widely touted use case of blockchain technology (decentralized and autonomous), allowing people to gather in groups (organizations) in a borderless, web-native way. While the internet has allowed for mass coordination, it still has a lot of friction and costs involved in it. Like traditional companies or social clubs, members work towards a common goal and/or have common interests. However, decision-making power is given to stakeholders (or token holders) instead of executives and board members, and no one person controls the direction that the group takes. Some of the potential benefits of a DAO are the relative agnostic view toward age and geography, contributing ultimately to the goal of meritocracy. DAOs have been increasing in popularity of late, and now control c. $10.3b in their treasuries and have 1.7m members.

Smart contracts form the backbone of DAOs, which define the rules of DAOs and hold DAOs’ treasuries. They ensure that the DAOs are run autonomously, where decisions are made by proposals and voting (different proposals can have different thresholds for approval), and the execution of any decision is also done automatically through smart contracts when conditions are met, with no need for human intervention. The consensus and trustless foundation of blockchain defends against corruption, and its immutability ensures that any decisions made and implications cannot be altered ex-post. A DAO is essentially a composition of smart contracts built on decentralized infrastructure and is performing the biggest experiment in new forms of alternative governance, at the grassroots level.

Some common classifications of DAOs are Protocol (e.g. Uniswap, Badger, Maker), Service (Yam Finance, Yield Guild Games), Grants (Uniswap Grants, Curve Grants), Media (Bankless), Social (Friends with Benefits, Krause House), Investment (Flamingo, DuckDAO), Platforms (DAOHaus, Aragon), and Collector (PleasrDAO, MeebitsDAO). Projects such as DAOHaus, Aragon, Colony, OpenLaw, and DAOstack provide the tools for creating and adopting of DAOs.

To better learn how a DAO works and how one may contribute and benefit from a DAO, there’s no better way than to learn by doing, and this memo will take you through the experience of participating in one.

Selecting a DAO

To start, you should ask yourself what you want to achieve from joining a DAO. To get a view of what DAOs there are, Messari and DeepDAO provide categorized lists, while CoinMarketCap gives a good overview. The next step is to spend some time shortlisting the ones that are of interest and may have objectives that align with your interests, and then visit their websites to look at their DAO introduction information which may be in the form of a Charter or simple documentation, which should cover areas such as the rights and responsibilities of a DAO member, the methods and rules of interaction with the DAO and its members, the governance of the DAO, tokenomics, and more.

The focus of this memo is on Bankless DAO (or bDAO). For context, a prominent web3-focused media channel is Bankless, which produces many informative and entertaining content weekly, through newsletters, videos, and podcasts. It brands itself as a program whose goal is to help people gain financial independence, with less reliance on central banks and commercial banks. The writer has been an avid listener of the Bankless podcast and first learned about bDAO. bDAO was started in May 2021, with the mission of helping people go bankless, by driving the adoption and awareness of bankless money systems like Ethereum, DeFi, and Bitcoin.

Joining the Bankless DAO

There are two options to get started with participating in bDAO. The first is to join as a full member, which will require 35,000 BANK, the DAO’s token, which can be bought on exchanges. Alternatively, one can join as a guest by introducing themselves, informing the community what their objective of joining the DAO is and how they plan to contribute, and then ask for a guest pass, which can be gifted by existing members. There are four different tiers or ‘circles’ of members in bDAO, as follows in increasing level of commitment:

- Guest Pass: members that do not have sufficient BANK but are still active in the DAO

- Level 1: members who have at least 35,000 BANK (They gain access to additional Discord channels and do not need to renew their membership, unlike Guests)

- Level 2: Contributors that have been nominated and voted into community leadership roles for going above and beyond, and this is put to a vote by members

- Level 3: “Whales”, those who have more than 150,000 BANK (at present c. 300+ addresses, and they gain access to additional Discord channels)

Coordination tools of bDAO

Like many DAOs, the main communication and coordination tool for the Bankless DAO is through their Discord server. There, one can access many different channels that span topics such as topical discussions (e.g. markets), and administration and utility (e.g. announcements, administrative support). The discord channel is considerably extensive due to a large number of Guilds (skill-based teams) and Projects (objective-based teams), but more on this later.

In bDAO, events take place over time periods called “seasons”. This would be akin to fiscal quarters, or fiscal years, in the corporate world, which are three months long and where budgeting, as well as strategic planning for the roadmap of the organization, is done. In between seasons, the DAO has a Gap Week to reflect on the past season and gear up for the next. The process is as follows: A bDAO member will develop an idea, propose it in the relevant Discord channel, and then put it to the vote as a poll. For an idea that is determined to be of large-enough importance, it is transcribed on a browser-based forum.

Projects and Guilds’ grants (i.e., mid-season activities that cannot or should not wait for the next season of funding, approved by a Grants Committee) and funding for proposals that they have planned to reach their goals for each season are posted there. Members can also comment on the proposals and vote there, while the work-in-progress proposals are maintained over Google Docs. The genesis proposal was about the participation of Bankless LLC (i.e. the media outlet) in Bankless DAO, and other examples of Season 3 proposals (running in the first calendar quarter of 2022) can be found here. For issues that have even larger implications and require longer-term work, the voting is moved outside of the forums, to Snapshot.

The reward system of the DAO is facilitated using Coordinape, which is a resource allocation tool that allows members to allocate a set number of tokens to their peers. bDAO sets aside a sum of BANK each month for contributors to quickly and transparently reward the value they see being created. In bDAO, DAO-wide round runs monthly, while guild and project rounds can have different timeframes. There are differences in each membership level’s ability to give or receive BANK.

What you can do with Bankless DAO

To start, bDAO has a notion page that makes it convenient to find all the key activities that a member can participate in, which is extremely useful as the DAO has grown to be quite sizeable.

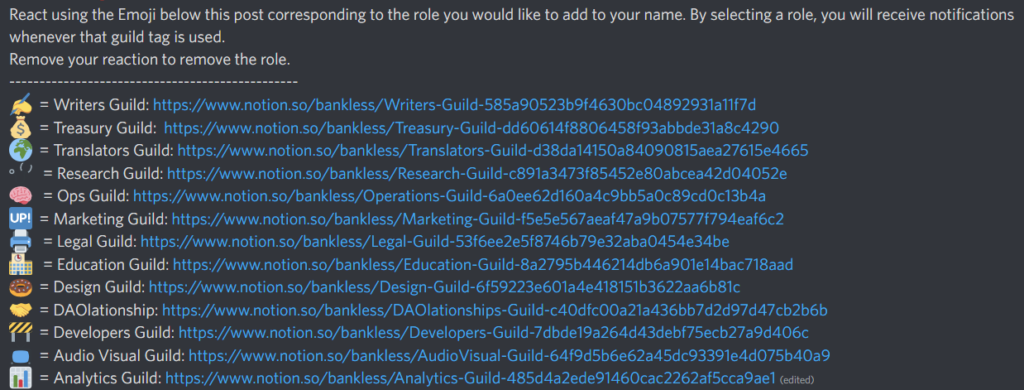

As mentioned in the previous section, bDAO makes use of Discord primarily for communication, and there are many channels dedicated to Guilds and Projects. Guilds are “labor pools that organize specialist skillsets into a single location”, or, according to our interpretation, formally recognized groups by the DAO, that specialize in certain functions or areas of interest of DAO members. We can think of them as specialized vertical business units. Guilds include: Writers, Treasury, Translators, Research, Ops, Marketing etc. Examples of Projects are First Quest (for new joiners), Website, Podcast Hatchery, and Bankless Consulting, which are more horizontal and operational in nature. There is a new joiners session to help with the onboarding.

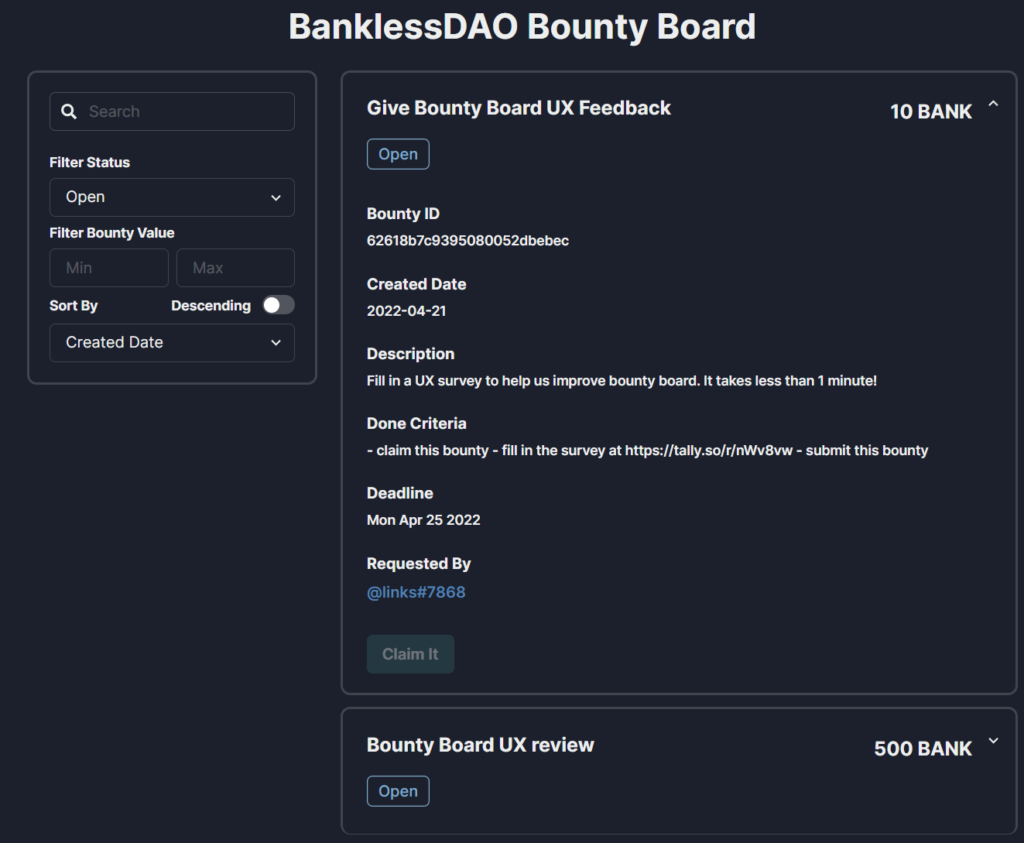

One of the first things one can do is to indicate their interest across these Guilds or Projects so they can be alerted to notifications to these groups and be up to date with the happenings, and hopefully find ways for which they can contribute. Contribution is also often rewarded with payment in the form of BANK tokens. In addition to contributing directly to the Guilds or Projects, there are other tasks that the DAO may require help with and can be found in the Bounty Board that a member can choose to undertake and earn BANK tokens. One can also earn BANK tokens from ‘tips’ from other members.

The Bankless Consulting team

One of the projects is the Bankless Consulting team, which touts itself as the world’s first web3-native consulting firm. Currently, it is largely in its formative stage, where it is concurrently ironing out its rules of engagement, improving on its capabilities through recruitment, and creating awareness through business development efforts.

Some of the proposed topics that it is aiming to provide consulting services includes web3 advisory (incl tokenomics, general project strategy), legal consulting (with regard to web3), DAO consulting, development & tooling advisory, educational services (i.e. coaching and teaching) as well as marketing & community advisory and management.

The participants are made up of individuals with diverse backgrounds, including web3 natives, as well as professionals from various industries spanning marketing, legal, banking etc., which form a strong base to for the project to build its capabilities on. However, while there is a high level of energy and discussion around web3 projects and the potential areas the team can work on, the challenge in the execution lies with the relatively low level of commitment by team members as compared to the level which is likely required by any customer if they choose to engage with the team. This is tied also to the constrain the team faces of being compensated minimally by the DAO, and dependent on any revenue it gets from project engagement by its customers. As a result, there is a chicken-and-egg problem of a lack of projects and revenue stream, which results in the team’s difficulty in achieving commitment from team members who are typically professionals that have full-time, well-paying jobs.

The Treasury Guild

The Treasury Guild is responsible for preserving, enhancing and supporting the DAO’s financial resources. In the TradFi context, this would be the same as the Finance department, where overall financial oversight including financing reporting, budgeting, bookkeeping, payables and receivables management and other finance functions are conducted. It maintains a publicly viewable ledger for each of the guilds here.

The Treasury Guild has a department called ‘Tokenomics’, which is focused on the economics of the BANK token. The workstreams it has, and their purposes, at present are:

- General Tokenomics: Supporting the operations of the tokonomics initiative

- Bank Utility: Optimize the value and utility of the BANK token

- L2 Migration: Optimize the costs of using BANK (at present, migrating to Polygon)

- Tokenomics Leveling Up Initative: Providing tokenomics education

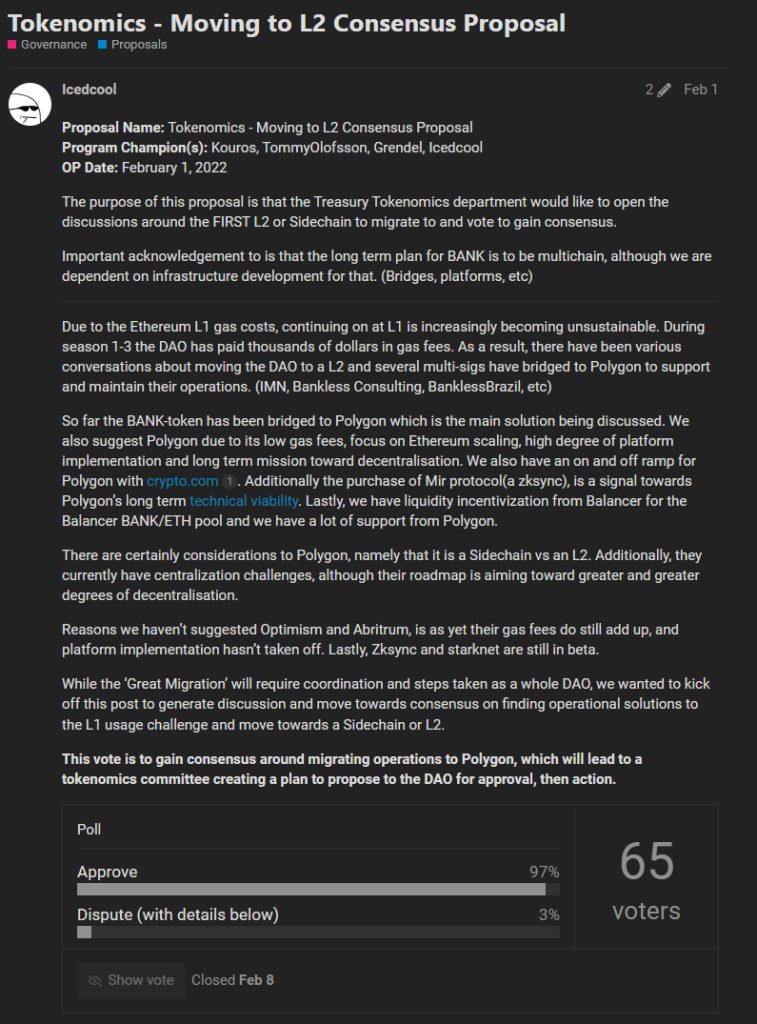

Some of the initiatives that the department has implemented included liquidity provider (LP) incentives with DeFi platforms Sushi and Balancer. At present, most activity for the department is on L2 migration, whereby the team evaluated L2 options to migrate BANK to, in order to mitigate costs of gas and hence enable wider contributor involvement. In Feb 22, bDAO approved the proposal to initiatate the migration to Polygon.

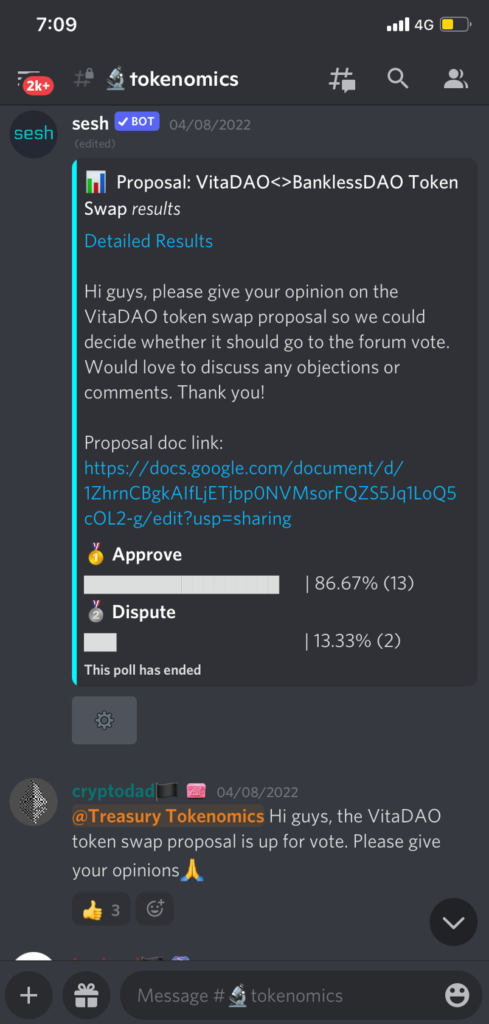

Apart from larger initiatives like the migration to Polygon, the Tokenomics department also has initiatives to diversify its treasury as well as to foster collaboration, through token swaps. One such example is its proposal of a $25k worth of token swap with VitaDAO, a community-owned collective funding early-stage longevity research. The token swap proposal was first put to a temperature check poll in the discord channel, and then to a vote in a forum poll.

The Bankless BED Index

Bankless (the media channel / program), in collaboration with Index Coop, a DAO that creates and maintains crypto-native structured products built on DeFi asset management primitives, created BED, which stands for “Bitcoin, Ethereum, and Defi” – the essential components of the open finance revolution that Bankless is aiming towards. It is based on the thesis that each of these holdings captures the upside of three investment crypto themes, in equal weight. BED is created using Set Protocol Infrastructure. Bankless has since gifted the methodology to bDAO.

BED aims to be a product for crypto beginners to onboard into crypto exposure without needing to execute multiple transactions on multiple platforms, incur high expenses from rising “gas” costs (like a processing fee on the network), or actively monitor the market to rebalance allocations.

The index is represented by a fully collateralized ERC20 token and is available for purchase on Uniswap v3, Index Coop, and TokenSets, and BED charges a 0.25% fee which is split 50–50 between Bankless and Index Coop.

Conclusion

bDAO has achieved a tremendous amount over a short few months since its founding, organizing itself across multiple working groups and interest groups, and the discord channel being a hive of activity. These groups form the backbone of the DAO, each of them bringing a unique capability or performing an integral function for the DAO that will be key for its development.

Nonetheless, there are still areas that it can and is improving on, for example, 1) Membership incentives – at present, BANK tokens are not viewed as high value, and one can participate in the DAO as a guest, with no material difference in experience from a full member. 2) International inclusion – schedules are predominantly centered around North America, and while there are international groups, these are relatively less active. 3) Record keeping – the quality of meeting notes varies widely. Standardized and consistently good record keeping will go a long way to helping any organization grow.

If 2020 was the year of DeFi and 2021 the year of NFTs, then it is not surprising that the rise in adoption and sophistication of these tools and use cases heralded the rise of DAOs, and for some to go so far as to view 2022 as the year where DAO adoption and development accelerates. The increased attention law-makers have for DAOs, for example in March 2022, Australian Senator Andrew Bragg spoking about the intention of lawmakers to regulate DAOs, following the Australian Senate Committee’s recommendation in October 2021 that DAOs be brought under the fold of the Corporations Act, which provides standards for corporate governance and personalities, should be viewed with optimism and the hope that it can encourage more participation in, and the “legitimizing” of, DAOs.

Sources

- DAOistry

- Linda Xie: A beginner’s guide to DAO

- 10 Industries Being Disrupted by DAOs

- Not Boring by Patrick McCormick: The DAO of DAOs

- Bankless DAO cheatsheet for new joiners

- bDAO forums

- HBR: What a DAO Can — and Can’t — Do

- DeFi and the DAO: How the Law Needs to Change to Accommodate Decentralized Autonomous Organizations