As the economic impact of the COVID-19 pandemic continues to spread globally, it is now commonly viewed to be a financial crisis masquerading as a health crisis and might change the world irrevocably. According to a survey conducted by IPSOS, there is increasing anxiety about personal finance and employment, with little comfort taken from the economic rescue measures cobbled together by governments. Few industries are spared from the economic collapse and the insurance industry is no exception.

Global consulting firm McKinsey claims that, in an observation unlikely to be unique to India, due to lockdowns resulting in fewer vehicles on the road, motor claims are expected to decline, and there may be a significant drop in motor insurance premiums after lockdowns end. However, insurers may see an uptick of business-continuity insurance claims and commercial-risk claims due to the economic slowdown. Across different distribution channels, digital is expected to experience a favorable impact, regardless of whether the on-going pandemic will result in a relatively optimistic scenario of delayed recovery or a prolonged contraction.

The value of India’s general (non-life) insurance market is projected to grow from INR1.6T ($24B) in 2017 to INR2.9T ($40B) in 2022

According to the India Brand Equity Foundation (IBEF), the overall insurance industry is expected to reach $280B by 2020, driven by a goldilocks combination of strong economic growth, a burgeoning middle-class with a growing interest and awareness in insurance among people, the use of internet facilitating distribution as well as supportive government policies.

The value of India’s general (non-life) insurance market is projected to grow from INR1.6T ($24B) in 2017 to INR2.9T ($40B) in 2022, according to a study by data and analytics company GlobalData. Motor insurance had the largest share (~40%) of the general insurance market, with gross premiums of INR608B ($9B) in 2017. A 2018 regulation mandating the sale of three and five-year third-party insurance policies on new vehicles, both contributed to growth. A recently passed law that penalizes driving without an insurance policy is also expected to contribute to this.

Overall insurance penetration is low, and premiums as a % of GDP were ~4% in 2017. This is even lower for general insurance, which was ~1% in 2017, as compared to ~2% and 3% in China and Brazil, respectively. Should motor insurance premiums be excluded, penetration is likely to be even lower.

Motor insurance uptake has been weak and is expected to remain so, as travel remains very much restricted and new motor sales are low

The insurance industry could likely see long-lasting, if not permanent, changes due to COVID-19, impacting all stakeholders in the industry, which includes consumers, insurers, and regulatory bodies. Among the most significant are that (1) consumers are likely to have a greater awareness of, and place a greater emphasis on, the need for insurance (2) insurers will see pressures on premium collection due to financial hardship and reduction in sales volume (3) regulatory bodies will need to respond by reviewing or enacting policies to facilitate the continued operations of insurers and ensure a minimum safety net for consumers.

In the aforementioned study by McKinsey, it was suggested that Indian insurers would benefit from a multi-year response, and, specifically with regard to servicing customers, that they: i) streamline their claims management processes, ii) implement digital underwriting and automated renewals, ii) innovate the product portfolio, and iv) modernize distribution channels.

Specifically for general insurance, the impact of COVID-19 is expected to be greater. Reversing strong positive pre-crisis trends, general insurance gross premiums underwritten fell 4.2% in the first three months of the fiscal year (i.e. Apr-Jun), supported by an uptick in health, fire, and crop insurance. Motor insurance uptake has been weak and is expected to remain so, as travel remains very much restricted and new motor sales are low. These are expected to recover very slowly, if at all. While this heralds a challenging new normal, it also begets new opportunities for companies, for companies like Acko.

Who are they?

Founded in 2016 by Varun Dua (CEO), Acko General Insurance is an InsurTech company based in Mumbai, India. They launched with motor insurance products and now also have corporate health insurance and personal health insurance products. Their sales channels can, at a high level, be split into i) direct to consumer from the website or app, and ii) in-app on its partners’ platform (e.g. Amazon checkout and Ola).

They hold a general insurance license from the Insurance Regulatory and Development Authority of India (IRDAI), making it one of the two tech startups to formally receive an IRDAI license. (Digit Insurance, backed by Fairfax Holdings, being the other).

At the end of 2019, they claimed to have ~1.5M policies underwritten a day, ~40M users, and an engineering team of >150. Their users now exceed 50M and they have a team of >400.

In response to COVID-19, they started offering health insurance in the form of “Arogya Sanjeevani” and “Corona Kavach”. Arogya Sanjeevani is an IRDAI recommended low-cost all-in-one health insurance plan introduced in April 2020, and covers hospitalisation costs, including treatment costs of COVID-19, while Corona Kavach is shorter-term (<1 year) COVID-19 specific health insurance policy, mandated by the IRDAI for general and health insurance providers to provide. In addition, they launched an AI-based COVID-19 symptom checker on their website.

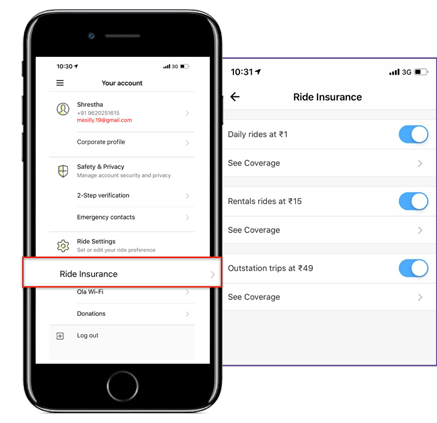

Some of the partners they have are: Amazon, Ola (ridesharing, food delivery), redBus (online bus ticketing), OYO (online budget hotel), Zomato (restaurant aggregator, food delivery) alongside whom they launched products such as trip insurance, electronics cover and hotel-stay insurance. One example is the innovative micro-insurance product, the Ola Trip Insurance, which protects passengers from eventualities (e.g. accidents, loss of baggage), and which they claim had >250M policies issued in 9 months and an average claim settlement time of 48-72 business hours.

What is their value proposition?

Acko is leveraging on the ability to access alternative forms of data, which traditional insurance providers such as banks and agents typically do not have access to, in order to have a more robust understanding of customers and hence come up with bespoke and differentiated prices for them. The ubiquity of mobile devices and usage of online services has increased tremendously in recent years, accelerated by the health crisis that has made that even more habituated, cementing the prospect of addressable market growth for technology-led services like Acko. Broadly, they address these key pain points of consumers as follows:

| Industry Pain Point | How Acko Addresses |

|---|---|

| Prices are high, partly due to a fragmented market and hence hard-to-compare prices with no go-to comparison platform | Acko claims that cost efficiencies and savings in running the company digitally are passed on to the customer. Premiums are kept low by creating a community of drivers who take care of their cars |

| One-size fits all policies which means you do not easily or necessarily get what you need and end up paying more than you should | Policy specifically produced for the vehicle (based on registered number), and consumer-chosen IDV as well as optional add-ons |

| It is cumbersome and tedious to purchase an insurance product, file or process claims, because of lengthy processes and hard-to-understand paperwork | All claims are done online (no paperwork) and cashless, with policy documents delivered within 2 minutes |

| These are exacerbated by poor, or non-existent customer services | Promise of 1-hour pick up in case of accident, 3-day doorstep delivery |

| There are lengthy terms and conditions and opaque claim approval processes | Acko emphasises on transparency, providing simple to understand and documented terms and conditions online, automatically sent to the customer for retention |

Importantly, as with insurance industries in fast-developing countries, a key challenge to succeeding is public awareness and acceptance of insurance. While consumers are relatively familiar with digital purchases, the focal points have largely been on eCommerce and daily consumption (payments, rides) and very much less so insurance. In Indonesia and many other parts of Southeast Asia, InsurTech companies have found it challenging to acquire customers because of the general lack of awareness and interest in insurance products, and there is still a lot to be done to educate them.

They have been innovative in their products. For example, their micro-insurance product, the Ola Trip Insurance, as mentioned earlier. They also offer mobile insurance right when a customer purchases their new mobile on Amazon, which takes away some of the friction in the purchase.

Even before the health crisis and arguably even more relevant because of it, their solution addresses large pain-points of customers. A breakdown of how they measure up against some of the (relevant) McKinsey proposed response to the crisis is as follows:

| Proposed response | How Acko measures up |

|---|---|

| Managing personnel well-being, minimize in-person meetings and encourage customers to opt for digital self-service and paperless processes | Digital by default |

| Support customers by communicating policy changes, facilitate digital claims processing and launch products related to the crisis | By default conducts all operations digitally and as mentioned, started offering health insurance in response to COVID-19 (Arogya Sanjeevani and Corona Kavach) |

| Streamlining the claims-management processes: upgrading chatbots, digitalise claims | Claims are digital by default and the claims submission flow is intuitive, easy-to-follow |

| Implementing digital underwriting and automated renewals | Renewals are not yet automated, Acko stresses that its digital interface makes it a safe and easy process |

| Innovating the product portfolio: more capital-efficient products with better flexibility and convenience, for specific risks or reward customers for maintaining related good habits | In the application process, Acko uses a slider for the customer to opt for the IDV they desire, as well as additional coverages (e.g. consumables, personal accident, zero depreciation) at checkout, even coupon codes |

| Modernizing distribution channels: abandon paper-based processes, drive the adoption of digital channels, for both standard and new requests | Digital by default |

| If recovery is delayed, focus on building or participating in ecosystems (e.g. embedding insurance journeys into customer ecosystems, providing a single interface for all financial services, and using digital and analytics to facilitate transitions between services) | Acko has multiple partnerships, for example, with Ola, redBus, Oyo, Zomato, ZestMoney, Amazon Seller (COVID Claims). It could continue embedding its service into partner apps, as it did with Ola, as well as Amazon Pay / Amazon app or mobile website |

Competitive landscape

While InsurTech in India is growing, startups in the industry are mostly marketplaces that allow consumers the comparison and purchase of policies offered by their partner insurers. Prominent online insurance aggregators/marketplaces include PolicyBazaar.com ($1B valuation, $200M raised in 2018 led by SBVF), Coverfox, BankBazaar (Amazon, Experian-backed), and Turtlemint. It is an extremely competitive industry, as evidenced by the turmoil at Coverfox, which was in talks with Paytm last year for a potential acquisition that fell through, and in early 2020 its co-founder/CTO as well as CEO left the company due to its struggles in raising capital and getting to profitability. This was the result of competition with deeper-pocketed rivals as well as losing market share to smaller and more nimble newer companies in the space.

Incumbents are looking to rise up to the challenge of innovating and hoping to capture a piece of the pie, making rapid strides in adopting technology in many important areas such as customer acquisition, applications, claims submission, and customer support. For example, HDFC ERGO has an Insurance Portfolio Organiser (IPO) app, which allows mobile access to policies, claims registration and claims, and offers services based on geo-location (although the user experience still looks dated and clunky). The National Insurance Company Limited, owned by the Government of India and is also the oldest general insurance company in the country, also has a chatbot that can answer basic queries, including directing a potential customer to the right site for the insurance they want.

Other non-India specific examples are: MassMutual (American mutual life insurance company) which established its corporate VC arm MassMutual Ventures, to learn and invest in new technologies, Chubb (the world’s largest publicly traded property and casualty insurance company) / NTUC / ZhongAn partnered with Grab to launch insurance products, and Allianz X, an accelerator to foster innovation through mentorship.

The industry is dynamic and can be challenging to keep up and stay relevant. Domestic players such as Ask Arvi and Riskcovry have pivoted into new businesses. Ask Arvi pivoted from an AI-powered chat-based insurance assistant platform to offering subscription-based parental healthcare (in the form of a home medical alert system) and has since ceased to exist. Riskcovry pivoted from a commercial insurance marketplace to an “Insurance-in-a-box”, white-label business, building APIs to support digital innovation for insurance companies and industry players.

| $US unless otherwise stated | Acko | Digit | GramCover (Insurance broking) |

|---|---|---|---|

| Founded | 2016 | 2017 | 2016 |

| Types of insurance | Car & Taxi Bike Health | Motor Health Other (shop, home, flight delay) | Livestock Motor Life, non-life |

| Number of customers | >50M | 9M | 1.3M 8K+ villages |

| Claims closed | – | 196K claims closed (Oct 19 – Mar 20) | 20K+ $10M premiums in FY19-20 |

| Others | Holds a general insurance license from the IRDAI (one of two tech startups) Repository of insurance related articles | Claims turnaround: 4 – 23 days (Oct 19 – Mar 20) 87 NPS (Mar 20) | Design customized & affordable rural insurance products; Plans to start Series A raise in Oct 20 and be profitable by Mar 21 |

| Notable investors | – | Fairfax Group | EMVC, Flourish, and Omidyar Network India, Omnivore |

Sources as linked directly

What is the team and who are the investors?

Acko was founded in 2016 by serial entrepreneur Varun Dua (CEO)

- Varun Dua (Founder, CEO) – Previously co-founded insurance broking firm Coverfox, and worked in the finance industry for over a decade

- Ruchi Deepak (Co-founder, Managing Director) – Previously focused on legal and compliance work across companies such as Coverfox, Matrix Partners, and Franklin Templeton Investments (where she was Varun’s colleague), in India and London

- Deepak Angrula (VP Engineering) – At Acko since November 2016, previously held various engineering roles, more recently at Coverfox Insurance, an online insurance broker and aggregator in India

- Jitendra Nayyar (CFO) – At Acko since June 2017, previously Group CFO of Renewal Power Manufacturing and Operating Utility, a solar power utility in India, and CFO of Aviva India

- Brijesh Unnithan (Head of Ops) – At Acko since June 2019, previously Country Head at Zoomcar

- Biresh Giri (Chief Officer – Actuarial, Product & Analytics) – At Acko since August 2017, previously multiple actuarial positions, more recently Chief Actuary and Head of Products at CignaTTK (JV between Manipal Group, company focused on healthcare delivery and higher education in India and Cigna Corporation, a global health services company)

They also have a board of directors which is represented by Dua, Deepak, and Angrula, as well as the following independent directors

- G.N. Agrawal – ex-Head of LIC’s Actuarial Division (Life Insurance Corporation of India, a state-owned insurange group and investment corporation)

- Srinivasan V. – Founder of CFO Bridge, provider of virtual/shared CFO services to SMEs. Previously CFO of Bharti AXA Life Insurance

They most recently raised $16M from growth capital provider Ascent Capital in November 2019, making a total of $123M raised. In March 2019, they raised a $65M Series C round led by Binny Bansal (Co-founder and former CEO of Flipkart), and participated by RPS Ventures (led by SoftBank’s former managing partner Kabir Mishra) as well as Intact Ventures (CVC of Intact Financial Corporation, the largest P&C insurance provider in Canada).

Their previous rounds were a $12M round in May 2018 led by Amazon India and Ashish Dhawan from India-based PE fund ChrysCapital, and a $30M seed round in May 2017, from Accel Partners and SAIF Partners.

Other investors of Acko are: Accel, Catamaran Ventures, Swiss Re Transamerica Ventures, and seasoned investors like Hemendra Kothari, Atul Nishar, Rajeev Gupta, Venk Krishnan, and Subba Rao.

What next for the company?

Acko needs to constantly create seamless customer experiences across the digital platforms that they offer their products on, and might even need to go online-to-offline. While launching on app and browser is a key differentiating factor, there might be times where having the traditional face-to-face channel might work better, especially if Acko choose to expand to offer products that are more personal and for convenience, should there be more complicated queries to be answered or on-behalf claims to be made. This can also serve to build customer loyalty.

In addition, they can also continue innovating on their products. The traditional “one-size-fits-all” is a clear antithesis of the future of insurance in India and Acko has, through products such as the Ola Trip Insurance, ventured into micro-insurance. Some other ways of doing so are usage-based insurance (e.g. pay-per-mile auto insurance), events-based insurance (e.g. insurance for delayed food delivery), and needs-based (e.g. insurance for a smartwatch). With a more extensive suite of products, Acko can also start bundling related ones for a customer. For example, a food delivery person might want pay-per-mile auto insurance, smartphone insurance, and food preparation delay insurance. Another company that is deconstructing the traditional underwriting of insurance and making it more bespoke and contextual is Toffee Insurance.

To deepen their strength in the ecosystem and improve customer satisfaction across the entire car ownership life cycle, they can also consider extending their reach beyond insurance. For example, through their acquisition of Mumbai-based online car buying portal VLer Technology, they can improve the channels with which they engage customers, and build deeper customer relationships. This allows them to also improve their offerings through moving towards a platform play, achieve better customer satisfaction, and capture more value across the value chain.

Anchoring their presence in the car ownership life cycle also allows them to capture more customer data. They should continually look to capitalise on the data that they are collecting of their customers. This entails not just capturing and tracking data, but also to have enhanced analytics to better serve customers with greater personalisation and help them to be laser-focused on customer-centricity.

Finally, the demise of players in the industry brings in sharp focus the tendency of founders to have “a solution looking for a problem”, which is commonly cautioned against. While there might be a potential opportunity in the market given the relatively low insurance penetration and high usage of technology-enabled devices, product-market fit still relies a lot on the value proposition to the customer and hence willingness to purchase, which, in this case, is closely tied to awareness and education. Acko can continue to do this by building upon its articles repository, and also potentially forming a community through discussion boards or forums to foster peer-to-peer learning and sharing, as challenger banks such as Revolut has.

In conclusion…

The insurance sector is ripe for disruption and there is an opportunity to tap on growing interest and awareness. The government is supportive, as evidenced through the passing of the Insurance Bill, which gives the IRDAI full flexibility to frame regulations for the sector, there are tax incentives on insurance products and 100% foreign direct investment is permitted for insurance intermediaries.

On top of the ability to use digital channels as efficient and cheaper forms of distribution, there is a large insurance gap in Asia. It is the continent with the largest number of natural catastrophe events, magnified by a low level of insurance penetration, which can be a strain on government resources and society. This implies a huge opportunity for InsurTech companies to serve the region, and it is an incentive for governments to continue supporting the growth of the industry.

Acko’s value proposition can become much stronger due to the COVID-19 pandemic, which has increased the adoption of technology, and the team looks well poised to keep up with the momentum of the business. It will be exciting to see how the future pans out for them.

Sources

- How Indian insurance companies can respond to coronavirus

- Indian general insurance market grows 14.5%

- Beyond COVID-19: Action plan for Singapore Insurance industry

- Non-life insurance companies’ gross direct premiums grow 7.83% to Rs 13,961.25 crore in June

- COVID-19 Health Insurance: Corona Kavach and Rakshak

- Acko is an ambitious digital play to disrupt India’s $10B insurance industry

- Acko General launches AI-based Covid-19 symptom checker

- Addressing the Insurance Gap in Asia

- Digital insurance: Opportunities and challenges for insurance companies in the digital world

- Overview of the Indian Insurance Sector and Opportunities in InsurTech

- Competing in a new age of insurance: How India is adopting emerging technologies

- India’s Insurers Embrace Digital’s New Normal

- 6 InsurTech Companies in India Featured in the Prestigious InsurTech100