There has been a large influx of challenger / neo- banks, which are technology-led and are aiming to disrupt the monolithic traditional banking business models, innovate and personalize products, and streamline processes. These banks range from traditional banks forking out their own brand of next-generation banks, as well as newcomers that tout disruption through the use of technology.

Common themes run across the value propositions of these challengers banks – that they will be more easily accessible through digitalization of products and services, provide a higher degree of personalization through technology-driven flexibility of customizing products and services, as well as recommendations that have higher degrees of relevance, leveraging data analytics for deeper customer insights.

Oxygen is aiming to bring these value propositions to the 1099/freelances, a group which is particularly underserved by banks at present.

Overview

Oxygen is a challenger bank that targets 1099/freelancers. Compared to the regular salaried worker, this group of workers is more reliant on archaic payment methods such as cash, paper checks or ACH payments. These methods are plagued with fraud and safety concerns, latency, unreliability, and durability issues.

They are underserved by banks, especially for credit products (e.g. loans, credit cards), due to the rigidity of loan requirements set by banks, which penalizes the freelancers’ irregular income pattern and at times lack of formal proof of income. They are also hard-hit by the banking fee structures such as minimum bank balances as well as fees for transactions and services.

Cash-flow management is a large pain point for freelancers, as they have to grapple with multiple sources of income and payments made to many different benefactors. Banks have them low on their target customer priority list due to their size, and the freelancers’ focus on work leaves them little time to adopt and learn the myriad of complex technology solutions that could help them with their challenges across cash-flow, inventory and customer relationship management.

They are on the Visa Fast Track program (another challenger bank, Chime, is on this as well), which will give them access to Visa’s network of partners across the fintech payment stack for more streamlined onboarding, expertise support, and reduced expenses. These allow for a faster and more efficient launch of a payment functionality to aid freelancers, and through Visa Direct, enable real-time push payments to help freelancers get paid faster and have better cash flow management.

The company follows a trend of digitization of financial services and that of freelance / gig work. By leveraging technology to provide financial products and services that are easier and quicker to access, have better flexibility for customization through leveraging an expanded data set as compared to banks, Oxygen can provide an all-in-one personal finance solution for freelancers. They especially target those who have multiple income streams coming in from contract work and freelance gigs, as well as diverse financial requirements. A key differentiator of digital banks is an estimated customer acquisition cost that is as low as 1/5 that of traditional banks.

In their initial launch in 2019, they focused on a credit product with a subscription fee and has since pivoted to focus on saving, spend, and rewards.

Market

According to a 2019 study commissioned by Upwork and Freelancers Union, the freelancing economy is close to $1T (~5% U.S. GDP), and the number of freelancers is 57M, growing by 4M since 2014 and now representing 35% of U.S. workers, and expected to be half the workforce by 2027. In the longer term, the share of freelancers who view freelancing as a long-term career choice rather than a temporary gig has been increasing, to about an equal share at present, as compared to 2014, when this was half that of those who viewed it as temporary.

Importantly, the definition of “freelancer” is very broad, including workers in the gig economy (e.g. ride-hailing, food delivery) as well as professionals that work on their own time, on project-based engagement, that could require niche skills (e.g. interior designer, tax specialist, photographer). They can also vary widely on their time commitment to this category of work, as some might work full-time, while others engage in gig work to supplement their main income, potentially driven by their interest and/or passion. In the case of the gig economy worker, they might have very different needs and wants, for example not requiring finance, accounting or tax software, or a separate business account, and could do with a simple business account. In this case, either the addressable market could be a lot smaller, or the number of competitors greater, or both.

Products and Services

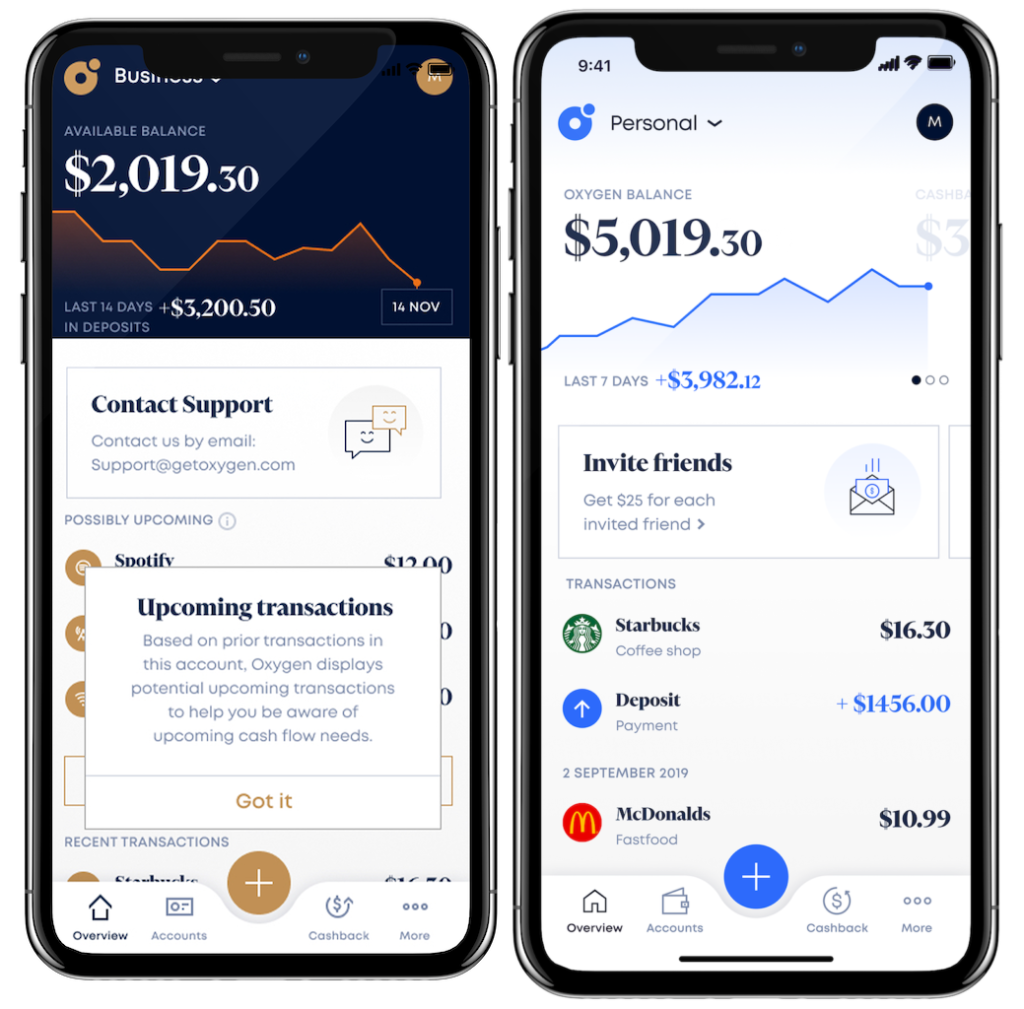

They have two main products at present: a Personal account and a Business account. Customers can easily toggle in the app between these two bank accounts.

| Feature | Personal | Business |

|---|---|---|

| Save | Deposit account via Bancorp Cash deposits via Green Dot subject to limits No interest-bearing accounts | Deposit account via Bancorp Cash deposits via Green Dot subject to limits No interest-bearing accounts |

| Spend / Transfer | Control monthly spend and merchants authorized No paper checks | Control monthly spend and merchants authorized No paper checks |

| Cards | Visa Debit card Up to 30 virtual cards; $2.5K per card Lock card through app | Visa Business Debit Card Up to 10 virtual cards; $1.0K per card Lock card through app |

| Rewards | Cashback rewards (e.g. 7% at Walmart/Trader Joe’s) | Cashback rewards |

| Fees | No monthly or minimum balance fees 1% international transaction fee | No monthly or minimum balance fees 1% international transaction fee |

| Support | Email, in-app chat, phone (working hours Mon – Sun; 24/7/365 for lost/stolen cards) | Email, in-app chat, phone (working hours Mon – Sun; 24/7/365 for lost/stolen cards) |

| Other functional features | Up to 2 days early deposit Flag expenses to record and classify | LLC creation Cashflow projections Integration with accounting tools Mail checks from the app |

| Others | Federal Deposit Insurance Corporation (FDIC) up to $250K through The Bancorp Bank | Federal Deposit Insurance Corporation (FDIC) up to $250K through The Bancorp Bank |

Financials and Key Metrics

Re-launched in May 2020, They have 100K users as of November 2020.

Competition

Azlo and Novo are the closer digital bank competitors in the U.S., offering freelancer-focused solutions. One main differentiating factor is that Oxygen also allows the customer to have both a personal account and a business account, and be able to switch seamlessly between the two. The table below attempts to summarize the competitive matrix.

| Feature | Oxygen (Business) | Cash (Square) | Azlo | Novo |

|---|---|---|---|---|

| Save | Deposit account via Bancorp Transfer through ACH transfer Cash deposit via Green Dot (e.g. in Walmart, CVS, Walgreens) subject to limits No interest-bearing accounts | Deposit account via Lincoln Savings Bank Top-up using debit and credit cards from Visa, MasterCard, American Express, and Discover, or have a bank account linked to Cash No interest-bearing accounts | Deposit account via BBVA USA Transfer through ACH transfer, PayPal / Venmo Check deposits from mobile app (1-6 business days, holds decrease as the customer builds deposit history) No interest-bearing accounts | Deposit account via Middlesex Federal Savings Transfer through ACH transfer, PayPal / Venmo No direct deposits or recurring payments No interest-bearing accounts |

| Spend / Transfer | Control monthly spend and merchants authorized No paper checks Mail checks from the app (No check deposits) | Receive P2P transfers through unique username $cashtag No fees to send or request payments between U.S. and U.K. Apple and Google Pay enabled | “Azlo Envelops” budgeting tool to set aside money for taxes, large expenses or payroll Instant transfers to external bank accounts by linking debit cards. (works with U.S. Visa or MasterCard Debit Cards, and prepaid cards, connect up to 5 cards that belong to one of the business owners listed on the Azlo account) Cash withdrawals via Allpoint ATM network ($1K per day, no fee refund) | Track monthly spend by merchant Instant transaction notification Apple and Google Pay enabled Instant check deposit via taking a photo Free transfers, mailed checks, and incoming wires |

| Cards | Visa Business Debit Card Up to 10 virtual cards; $1.0K per card Lock card through app | “Cash Card” – Visa Debit Card (optional) Lock card through app | Visa Debit Card | MasterCard Debit Card No virtual cards |

| Rewards | Cashback rewards | Cashback rewards (Boost) | None | “Novo Perks” are offers from partners that customers can take advantage of (e.g. cashback on booking.com, Google Cloud credit) |

| Fees | No monthly or minimum balance fees 1% international transaction fee | No monthly or minimum balance fees (is a stored value facility) 3% fee for credit card top ups 1.5% fee to expedite transfers from Cash App to bank account 1.x%+ fee on bitcoin purchases No international transfer fees (mid-market exchange rate used) | No monthly or minimum balance fees No fees for mobile check deposits, bank to bank (ACH) transfers, and incoming international and domestic wires No overdraft fees Fees to expedite transfers out of Azlo | No monthly or minimum balance fees ATM fees are refunded |

| Support | Email, in-app chat, phone (working hours Mon – Sun; 24/7/365 for lost/stolen cards) | Email, in-app contact, no direct phone line support (no indication of uptime) | Email, contact-us webpage, in-app chat, web chat bot, phone line support | “Human-powered” (favorable reviewed) |

| Other functional features | LLC creation Cashflow projections Integration with accounting tools | Pilot short-term (4-weeks) loans ($20-$200) to selected users QR code payments Investments (stocks and bitcoin) Up to 2 days early deposit Cash withdrawal at ATM with $2 fee (waived for those who credit at least $300 paycheck every 31 days) | Integration with small business tools (e.g. QuickBooks, Xero, Wave for accounting; Stripe, Square, PayPal for payments) | Integration with small business tools (e.g. TransferWise for remittance, Slack for collaboration, Xero for accounting and Stripe for payments) |

| Others | Federal Deposit Insurance Corporation (FDIC) up to $250K through The Bancorp Bank | Premium feature includes changing the design of Cash Card For merchants that accept Cash App payments – 2.75% per transaction Not FDIC insured | “Azlo Pro” ($10 per month) enhances the features of “Azlo Starter”, including automated transactions, lower funds transfer fees, integration to finance / invoicing tools, access to “Azlo University”, a library of guides on business, marketing, and financial management Federal Deposit Insurance Corporation (FDIC) up to $250K through BBVA USA | Federal Deposit Insurance Corporation (FDIC) up to $250K through Middlesex Federal Savings |

| Countries | U.S. | U.S., U.K. | U.S. | U.S. |

The table below attempts to summarize the competitive landscape. Digital banking apps that are more popular, such as Chime, Varo, and Earnin target the lower-mass to mass segments, while traditional banks target the affluent and larger transaction volumes (e.g. Chase Sapphire, Amex Platinum/Gold).

| Name of Bank (launch date) | Description |

|---|---|

| Traditional bank affiliated / created | |

| Greenhouse (2017) Wells Fargo | Stopped taking applications in July 2020 as they “pause to evaluate the pilot learnings and plan for future product development” |

| Finn (2018) JP Morgan Chase | Ceased operations in early 2019, as it was determined that “Chase was best positioned to provide that combination of services to its customers, according to people familiar with the matter, rendering Finn unnecessary.” |

| PurePoint Financial (2017) Union Bank (CA) | For geographic expansion beyond the west coast. Products include an online savings account and certificate of deposits (CDs). |

| Citizens Access (2018) Citizens Financial Group (RI) | For geographic expansion beyond Rhode Island. Products include an online savings account and certificate of deposits (incl CD ladder). |

| Bó (2019) RBS / Natwest (U.K.) | Ceased operations in 2020 (6 mos). “Piggybank” (no-interest) savings account, real-time transactions alerts, no foreign transaction fees |

| mettle (2019) RBS / NatWest (U.K.) | Integration with accounting software (FreeAgent, Xero, Quickbooks), in-app invoicing, free access to online accounting software (FreeAgent) |

| Challenger banks | |

| Chime (2014) | Multiple fee-free products, including early wage access, checking accounts with no minimum balance, fee-free overdraft, and automatic savings and 1% APY savings account |

| Varo (2017) | Multiple fee-free products including early wage access, checking accounts with no minimum balance (also no transfer fees or foreign transaction fees). Savings account base interest rate of 0.81% APY up to 2.80% APY with debit card purchases and receiving direct deposits |

| Dave (2019) | Features include: “Side Hustle” which helps customers find gig work, and “Build Credit”, to help customers build credit through reporting rent and utility payments to major credit bureaus, in partnership with LevelCredit |

| Lili (2019) | Freelancer-targeting bank that has features including expense categorization, tax bucketing (automatically set aside income for taxes) and expenses reports |

| Other FS firms targeting gig-economy | |

| Qwil (2015) | Working capital management: On-demand capital and early pay |

| Joust (2017) Acquired by ZenBusiness in July 2020, 6 months after launch | Freelancer/self-employed focused banking app including analytics dashboard, debit card and invoice management |

| Wollit (2020) | Smooths income by connecting directly to a user’s bank account to estimate monthly eligible income; cash-topups are the difference between the average income and how much was earned the previous month Monthly service fees form a part of a regulated loan agreement and payments are reported to a credit agency, hence positive payments history can help to build credit |

Team and Hiring Plan

- Hussein Ahmed (Founder, CEO) – Previously co-founder at Transpose Technologies, a collaborative software platform for businesses to manage projects, data and assignments etc. 1 year of engineering manager experience at Amazon and 3 years as Head of Engineering at VTLS (now Innovative Interfaces), a company that provided library automation software and services. He also has experience consulting companies on product design, go-to-market launches, and product marketing strategy. He holds a Ph.D. in Computer Science from Virginia Tech and an MBA from UC Berkeley Haas

- Ivy Lu (Head of Data Science & Machine Learning) – Previously data scientist / machine learning engineer at Apple and Capital One. She holds a Ph.D. in Earth Systems and Geoinformation Science from George Mason University and B.S. Geographical Information System from Peking University

- Jonathan Consalvo (Chief Compliance Officer) – Previously risk consultant at Treliant Risk Advisors, a multi-industry consulting firm. He holds an MBA from UC Berkeley Haas and B.A. Political Economy from Tulane University

- Ryan Conway (Head of Business Development & Strategic Partnerships) – Previously Director Digital Partnerships at Mastercard and BD roles at BlueSnap (payment platform) and Worldpay (FIS; payments).

They are currently hiring a Chief of Staff, and their previous Chief Risk Officer, Dianne Clapp left in February 2020, as well as their VP Operations & Risk Strategy, Mike Garris, in November 2020.

Key Risks

There are many competitors in the digital banking space and while their core value propositions are similar (i.e. digital-first/only, greater accessibility and customizability, etc.), there is not one that specifically targets freelancers, who have unique pain-points and needs (e.g. cash flow management, business expansion, adopting new technologies), hence creating a niche market opportunity.

While digital banks are increasingly common, an important requirement of financial services and banking adoption is trust and security. Customers might be drawn to a product because of promotions (e.g. aggressive high-interest rates or cashback), but it will be challenging to retain them if these are stopped, which is likely to be the case if the company takes the sensible view of a path to profitability. Hence, digital banks like Oxygen, in carving out their niche, will need to have highly relevant products for them. In this case, seamless integration to existing business apps such as finance and accounting, inventory management, communications, and collaboration, or time management and scheduling will be differentiating and attractive. Being able to enter into partnerships agreements and/or integrate directly into revenue streams of freelancers (e.g. Twitch, Teachable, TaskRabbit) will also be valuable.

Profit drivers for digital banks mostly lean towards credit products, and for these products to be priced and administered effectively, the digital banks will have to first have sufficient data points of their customers and subsequently effective credit and risk decision models, as well as efficient collection and disbursement channels. This applies also to any other opportunity to cross-sell. While interchange fees can be revenue drivers in the short term, while the digital bank builds transactions and deposits volume, the cost of funds will likely well erode any potential profit margins. Until both a sizeable deposit base and customer data points are accumulated, it is likely that the digital bank will still be burning cash, and the path to profitability might take years, over which incumbent banks and other financial services competitors can innovate and compete.

Customer acquisition costs and retention costs can also increase if more competitors enter the market and aggressively price and promote their products and services. As incumbent banks innovate, it will also become increasingly difficult to attract and retain customers.

Recommendation

The line between regular working hours and flexible work arrangements has rapidly blurred, most recently driven rapidly by the COVID-19 pandemic, which has pushed skilled workers to turn to freelance work. Increasingly, freelance work is viewed as a sustainable long-term career choice as compared to a side income stream. The recent growth of the freelance economy is likely here to stay, as workers are discovering the benefits of freelancing, which include more flexible work arrangements (e.g. hours, location) as well as risk management through diversification of sources of income (e.g. more clients / employers, across different industries).

Oxygen differentiates from its closest competitors by allowing a seamless transition between personal and business accounts, which is valuable to the freelancer, as it helps with clearer separation and hence calculation of financial standing and regulatory (tax) reporting, which are huge pain points for them, as they are time-starved and have a desire to focus on their work, where they add the most value and generate income. In the longer term, they can diversify their products, for example, higher interest savings accounts, credit products, investment products, and remittance, which can deepen their customer value proposition.